The Curious Mind: Marko & Luke on Markets, Politics and Global Order, Mental Health & Our Youth, Be More Interesting, How The Chip Industry Really Works, Charts You Missed, The Future of Robots....

October 9, 2024

I am sharing this weekly email with you because I count you in the group of people I learn from and enjoy being around.

What did you enjoy learning this week?

If you missed last week’s discussion: Tepper on Markets, The Changing Economic & Investment Landscape, Ted Seides on Investment Paradigms, Life Advice, Personalised AI, Intelligent Machines, Investing in Healthcare....

This email takes many hours to put together, including hours of sourcing, curating and writing. If it is helpful to you, then do me a favor and hit the “heart” button so I know it’s useful to you.

Quotes I Am Thinking About:

"Our goal should be to live life in radical amazement. ....get up in the morning and look at the world in a way that takes nothing for granted. Everything is phenomenal; everything is incredible; never treat life casually. To be spiritual is to be amazed."

- Rabbi Abraham Joshua Heschel

"Wisdom begins in wonder."

- Socrates

“Always be on the lookout for the presence of wonder.”

- EB White

“Wisdom flourishes in the garden of perpetual amazement."

- Rabindranath Tagore

"The wisest minds never lose their childlike sense of awe."

- Maya Angelou

A. A Few Things Worth Checking Out

1. On Markets and Geopolitics

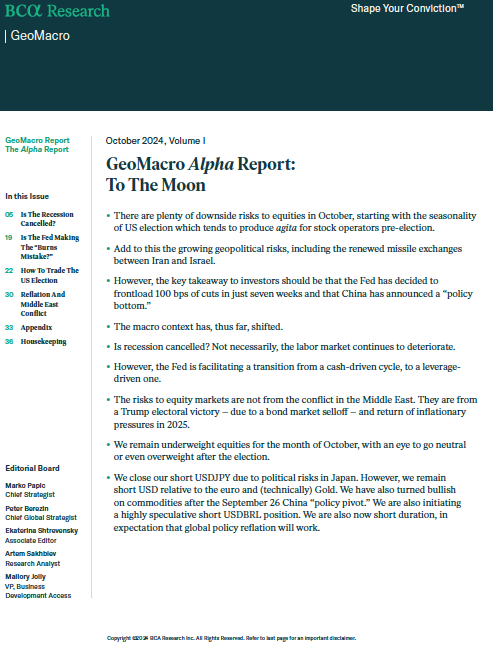

Marko Papic and the team at BCA shared their latest views, if you’d like a little more deep dive, Marko was on the Jacob Shapiro podcast (1st 30 mins is Middle East, then China, finishing with US elections).

The 5 BIG IDEAS:

Economic and Market Outlook: Marko predicts potential market turbulence if Trump wins the 2024 election. He anticipates a bond sell-off similar to 2016, but warns it could cause a stock market crash due to the current positive correlation between bonds and equities. He also suggests gold's recent performance might indicate underpriced long-term inflation expectations.

Geopolitical Perspectives: Marko argues Trump could paradoxically be good for world peace, citing his unconventional but effective negotiation tactics. Conversely, Jacob expresses concerns about Trump potentially destabilizing key alliances (NATO, Japan, South Korea). They both agree the Ukraine conflict is at a stalemate, with Marko proposing Ukraine should adopt an "Azerbaijan-style" long-term strategy.

The Iran-Saudi Arabia Deal's Significance: Marko emphasizes this deal's importance in regional stability and market risk perceptions. He argues Saudi Arabia has essentially ceded influence in Syria, Yemen, and Iraq to Iran in exchange for focusing on economic development, fundamentally altering Middle East dynamics.

Global Economic Power Shifts: They discuss the potential shift from U.S. dominance in global market cap rankings towards a more balanced global distribution. Marko presents data showing the growing importance of the "Global South" in global capital pools, suggesting investors should consider diversifying beyond the U.S.

Federal Reserve Policy and Politics: Marko argues the Fed's recent policy decisions have been politically motivated, aimed at preventing a Trump presidency in 2024. He suggests the Fed's pivot towards rate cuts in late 2023 and early 2024 lacked strong macroeconomic justification, highlighting the intersection of monetary policy and political considerations.

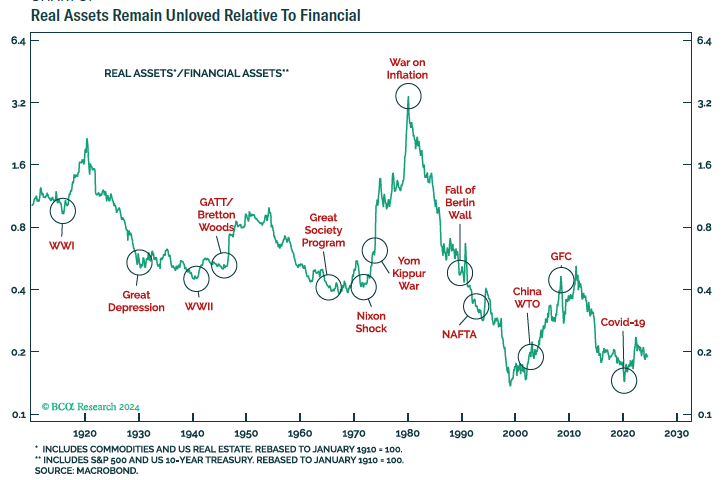

2. On Gold, Interest Rates and the Global Order:

A lot more conversations around Gold, interest rates and financing the US deficit. This conversations on Macro Voices with Luke Gromen who writes Forest for the Trees was helpful to think about the dynamics.

TLDR:

There is a profound transformation of the global financial landscape. The post-Bretton Woods international monetary system, centered on US dollar hegemony, appears to be under increasing strain. As the US relies more heavily on short-term financing and market intervention, other global powers are actively seeking alternatives to dollar dependence. This shift is most visible in energy markets and central bank reserve management practices.

The 5 BIG IDEAS:

Fundamental restructuring of US Treasury financing: There is a shift from long-term bonds to short-term T-bills, driven by changing global demand dynamics. Foreign central banks' withdrawal from Treasury market after decades of support. Increasing reliance on "hot money" from hedge funds via tax havens (e.g., Cayman Islands, Luxembourg)

Unprecedented expansion of US debt roll-over: Weekly debt roll-over surged from $100 billion (2013) to $500 billion (2024), a 16% CAGR over 11 years. This forces more frequent, shorter-term debt issuances, creating a self-reinforcing cycle and raises questions about long-term sustainability of US fiscal policy.

Fed and Treasury's evolving role in market stabilization: Active management of Treasury market volatility through liquidity injections. Creation of a de facto "Fed put" on Treasury volatility, indirectly supporting equity markets. Long-term concern: Erosion of central bank independence and credibility

Gold's re-emergence in the global financial architecture: Gold-to-oil ratio increase from ~8 (2008) to 39 (2024), signaling stress in the petrodollar system. Accelerated gold accumulation by central banks, especially in non-Western countries. Broader implications: a) Shift in global reserve preferences away from fiat currencies b) Potential return to a partial gold standard or gold-backed trade settlement c) Challenges to dollar hegemony in international finance.

Transformation of global energy markets and trade settlement: Growing trend of oil sales in non-dollar currencies Shift from recycling petrodollars into US Treasuries to storing surpluses in gold. Far-reaching consequences: a) Gradual erosion of the US dollar's global reserve currency status b) Emergence of a multipolar or fragmented global financial system c) Potential for increased geopolitical tensions as financial power shifts.

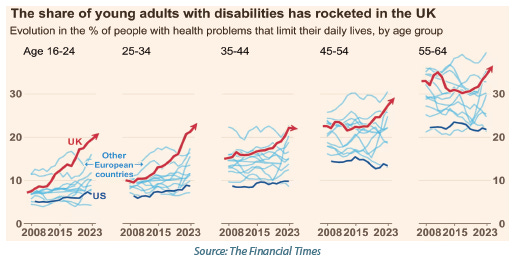

3. On Mental Health and our Youth:

WILTW / 13D had a thoughtful article titled: Economic malaise is worsening the mental health crisis for young adults.

Key Ideas:

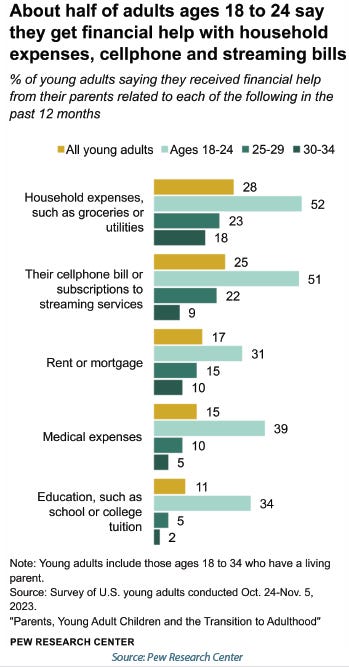

The evolving landscape of youth mental health: 1 in 5 UK individuals aged 8-25 have a mental health disorder; US depression rates 50% higher in 18-24 year olds vs. older adults. In the UK, young people reporting serious health issues, including chronic mental health conditions, has tripled between 2008 and 2023.

Economic pressures and their psychological manifestations: Pervasive financial insecurity is reshaping traditional life milestones and expectations. Coping mechanisms like "treat culture" provide temporary relief but mask deeper economic anxieties. These pressures are creating a new economic psychology among youth, characterized by short-term coping and long-term pessimism.

Generational economic disparities and structural challenges: Young people accumulating debt without corresponding valuable assets. Prolonged financial dependence: Nearly half of young adults rely on parental financial support.

The intricate feedback loop of mental health and economic instability: Bidirectional relationship - Poor mental health reduces economic opportunities, while financial stress exacerbates mental health issues.

Labor market detachment: One-third of 18-24 year olds report no wage or salary, highlighting severe economic disengagement.

Urgent need for comprehensive, multi-pronged solutions: a) Targeted investments in education and job training b) Enhanced mental health support systems c) Policy interventions to address structural economic barriers d) Potential reevaluation of social support systems to meet evolving needs.

4. On Being More Interesting:

Great storytelling is a powerful skill, and stories are everywhere, from the memos we are writing, to the presentations we are giving, to the conversations we are having.

Shane Parrish sat down with Matthew Dicks, a renowned storyteller, author, and teacher, to explore the nuanced art of storytelling.

They go deep into the techniques that turn mediocre stories into masterful ones. This conversation covers broad frameworks, like how to structure a great story—and details, like when you should talk quietly to refocus the audience.

This conversation had me smiling and thinking about all the stories that surround our lives.

You’ll learn what makes a story truly resonate with an audience, how to identify and highlight the pivotal moments that create emotional impact, the architecture of compelling stories, how to structure narratives for maximum engagement, and how to use techniques like suspense, stakes, and humor to keep audiences on the edge of their seats.

The 4 BIG IDEAS:

Master the art of story structure and delivery:

Begin with a captivating opening that creates curiosity

Use the BABC model: Begin in the middle (B), flashback to the beginning (A), return to the middle (B), then conclude (C)

Focus on change over time - ensure start and end points contrast significantly

Cultivate and maintain audience engagement:

Employ stakes, suspense, surprise, and humor strategically

Create "elephants" (attention-grabbing elements), "backpacks" (loaded expectations), "breadcrumbs" (subtle hints), "hourglasses" (intentional pauses), and "crystal balls" (predictions)

Constantly ask: "If the power went out now, would people care?"

Craft language and structure for maximum impact:

Use specific, vivid language that activates the audience's imagination

Employ the power of contrast and negation (e.g., "not stupid" instead of just "smart")

Don't be afraid to use pauses and silence for effect

Develop a storyteller's mindset:

Practice strategic listening: analyze why certain stories or moments are effective

Collect small, meaningful moments from your life (homework for life)

Always look for the story in everyday events and interactions

B. The Science and Technology Section

1. On Semiconductors and AI

We hear about chips on a daily basis, but how does the Semiconductor Industry Actually Work?

Dylan Patel runs Semianalysis, the leading publication and research firm on AI hardware. Jon Y runs Asianometry, the world’s best YouTube channel on semiconductors and business history. They both spoke to Dwarkesh Patel.

The 4 BIG IDEAS:

The AI Compute Race and Its Economic Implications:

Unprecedented scale of centralization in AI compute, with plans for multi-gigawatt data centers, leading to xponential growth predictions: aiming for 1e30 flops by 2028-2029, a 100,000x increase from GPT-4, which then leads to massive capital investments: predictions of $50-100 billion fundraises for leading AI companies.

Pascal's Wager mentality in tech leadership: investing heavily to avoid falling behind.

Semiconductor Industry Dynamics and Innovation Frontiers:

Extreme specialization leading to siloed knowledge and the need for "master-apprentice" knowledge transfer.

AI's potential to revolutionize chip design: possibilities for 100x gains from architectural advancements. The role of advanced packaging and emerging technologies like chiplets. Potential for breakthroughs in memory technology to transform the industry.

Geopolitical Landscape and Its Impact on Tech Development:

China's potential advantages: ability to centralize resources and build infrastructure rapidly.

Divergence in AI capabilities: China's strength in image/video recognition vs. Western focus areas.

The strategic importance of controlling key technologies in the AI supply chain.

Transformation of the Global Compute Infrastructure:

Challenges in power delivery, cooling, and data center construction becoming key bottlenecks.

Innovative solutions emerging: use of mobile generators, on-site power plants, retrofitting existing facilities.

The potential for unconventional locations (e.g., Ethiopia, Middle East) to become AI compute hubs.

This was a good X / twitter thread summarising the discussion.

C. News And Charts You Have Missed

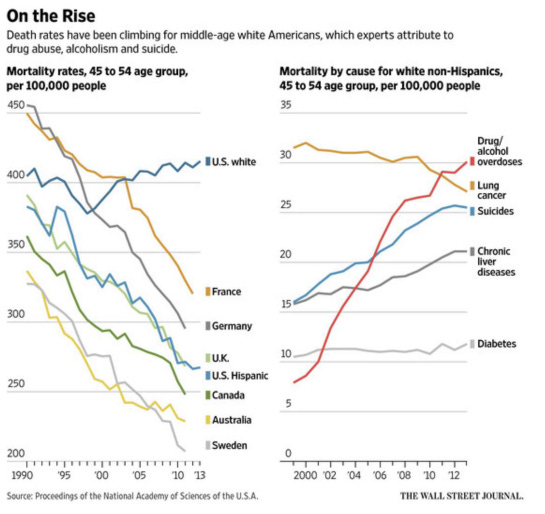

1. Deaths of Despair.

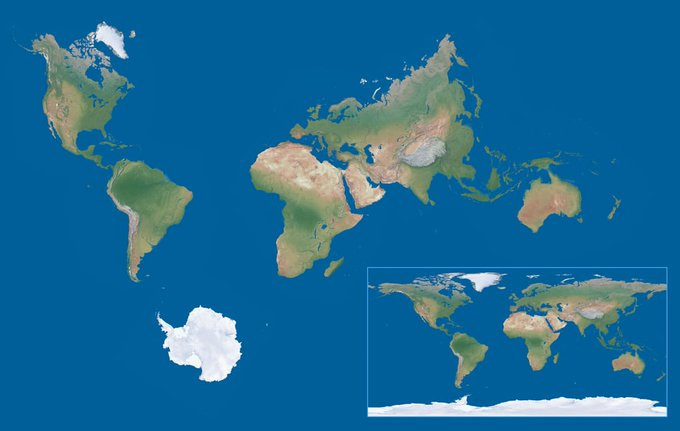

2. Mercator Projection versus Reality.

3. It’s amazing the dance we are doing hurtling through space.

D. The Curious Mind Event Series

What does the world and work look like in 10 years when there are 1.4 billion AI-robots running around?

This report by Citi discusses the technological advances making this possible and its impact on you.

We will be hosting a virtual session with the author Robert Garlick, Head of Innovation, Technology and Future of Work Research at Citi, on October 21 12pm EST.

Would you like to join?

P.S. Could you do me a favor ? This email takes many hours to put together, including hours of sourcing, curating and writing. If it is helpful to you, then do me a favor and hit the “heart” button so I know it’s useful to you.

This was fun.

The range of topics covered in your posts never ceases to amaze me. Well done again.