The Curious Mind: Power of Strategic Reading, Marko on Markets, Scott Bessent on The Road Ahead, Setting The Table, The Paranoid Survive, Khosla on The Improbable, Doudna on Gene Editing, Humanoids...

October 25, 2024

I am sharing this weekly email with you because I count you in the group of people I learn from and enjoy being around.

What did you enjoy learning this week?

If you missed last week’s discussion: How Have Markets Changed & What Will AI Do?, Eleven Wisdom Tools, Reframe Experience & Reshape Your Life, Complexity & Power Law in Investing, How To Succeed, Jensen on Computing....

This email takes many hours to put together, including hours of sourcing, curating and writing. If it is helpful to you, then do me a favor and hit the “heart” button so I know it’s useful to you.

Quotes I Am Thinking About:

“Conformity is the jailer of the freedom and enemy of growth.”

- John Kennedy

”There are no great limits to growth because there are no limits of human intelligence, imagination, and wonder."

– Ronald Reagan

“A wise man does at once, what a fool does at last.”

- Baltasar Gracian

"In many cases, you'll find the only thing preventing you from learning is your ego.

No one enjoys feeling foolish, but attempting something new requires that you climb down from your perch and struggle as a beginner. You must ask questions that reveal your ignorance or attempt skills that make you look uncoordinated.

Learning demands the willingness to live in a brief state of discomfort. You must believe that looking like a fool for an hour will not ruin your reputation for life."

- James Clear

A. A Few Things Worth Checking Out:

1. How can reading give you an investment edge and an edge in life?

The answer is Strategic Reading.

One of my favorite people, Alix Pasquet published a smart presentation this week on what he calls "strategic reading."

You should watch and read anything Alix shares.

Reading creates leverage: it can improve your network, it can make you money, and perhaps most importantly, it teaches you how to communicate. It's those that communicate well that are given positions of responsibility.

What's particularly striking is how he connects reading and learning to practical market dynamics and institutional behavior patterns. This creates a feedback loop where deep reading informs market understanding, which in turn guides what and how to read.

The 3 BIG IDEAS:

Reading as Development of Proprietary "Visualization Technology": Modern environments (social media, AI) are degrading our natural visualization abilities. Reading develops crucial mental capabilities:

Ability to "run movies in your mind" about business scenarios

Incubation time for ideas to germinate (vs instant AI answers)

Pattern recognition across different contexts

Multi-Dimensional Learning System:

Different Types of Reading:

Hard knowledge (strategy, finance)

Soft knowledge (psychology, influence)

Military/Sports/Intelligence (because "if it didn't work, people would die")

Fiction (for emotional understanding)

Philosophy (for different perspectives)

Learning Projects and Knowledge Integration: Annual deep dives into new domains. Finding "filter aggregators" (people who curate knowledge). Teaching others to cement understanding. Looking for "unusual questions" about businesses. Connecting dots across disciplines. Using personality-aligned research (extroverts start with calls, introverts with reading).

If you love reading, but never have enough time, check out SuperSummary. I fell in love within 10 minutes!

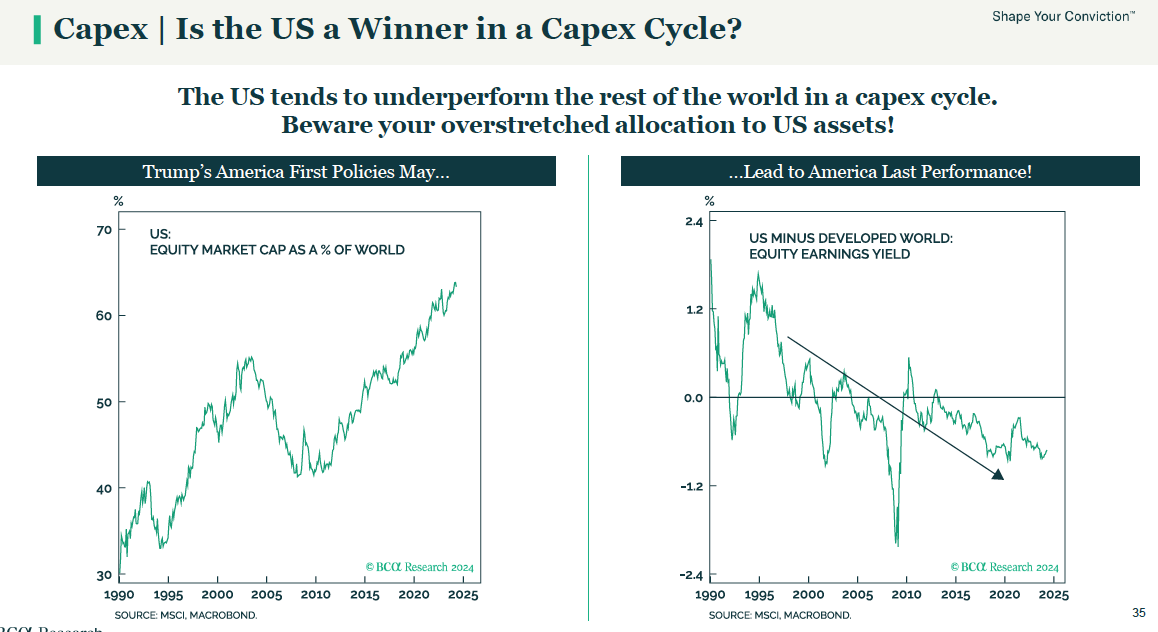

2. The latest from my favourite Market strategist - Marko Papic. Spent a lot of time with Marko this week and walked away with following ideas that I will summarise in short paragraphs.

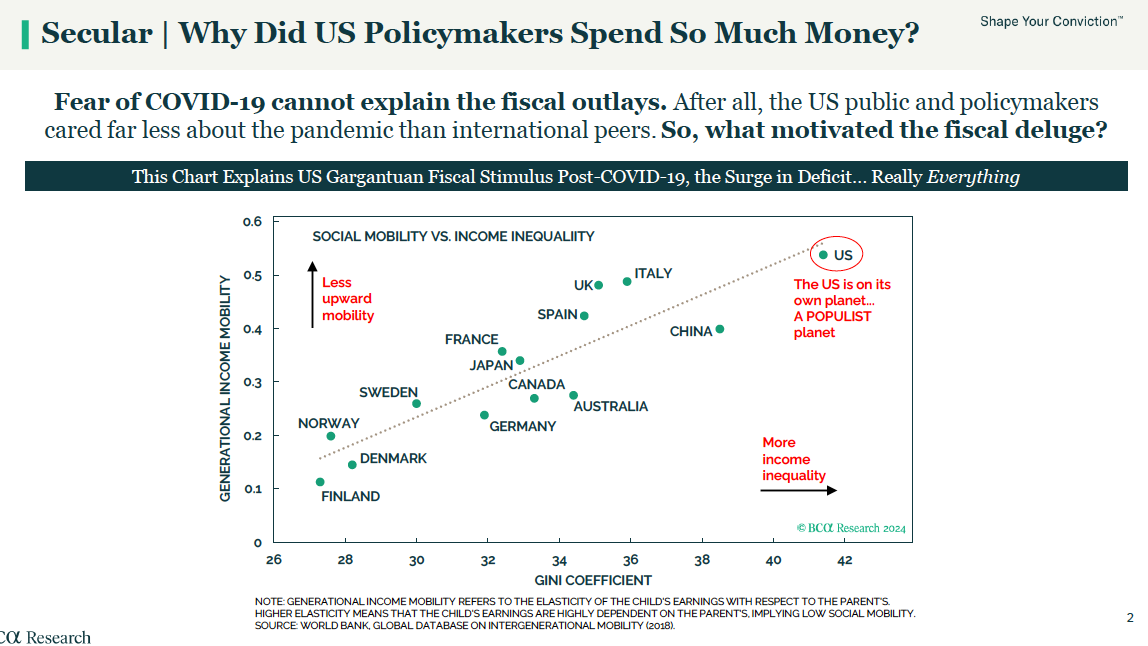

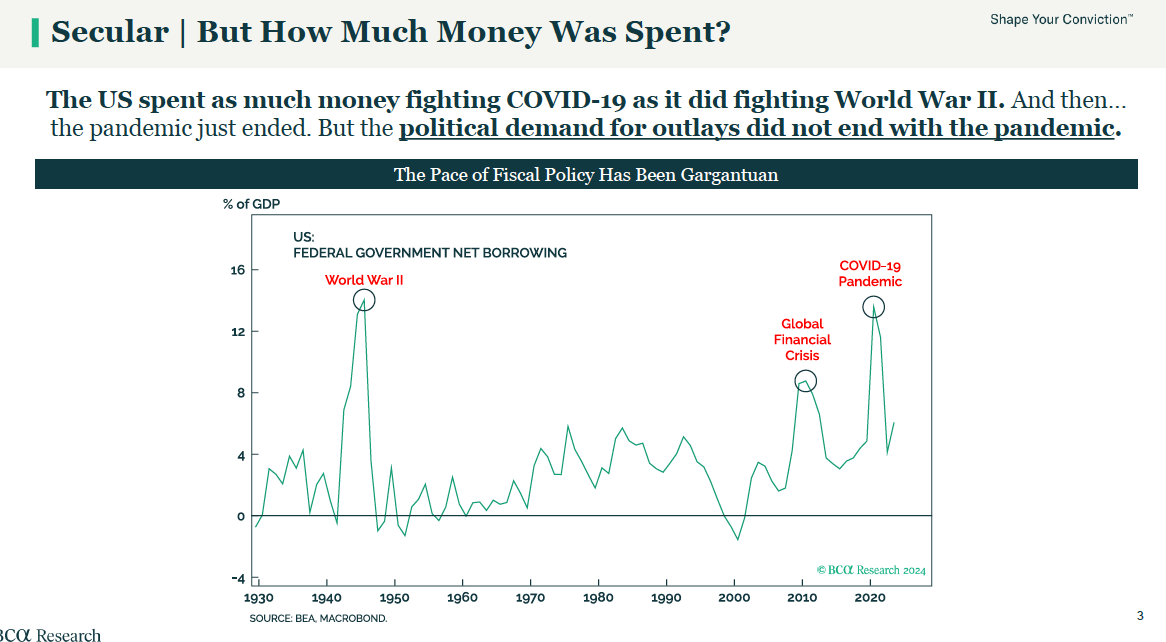

US Wealth and Income Disparity: key to many issues we see today. Since we can’t get to political solution, we are working on less efficient ones. More in the charts below.

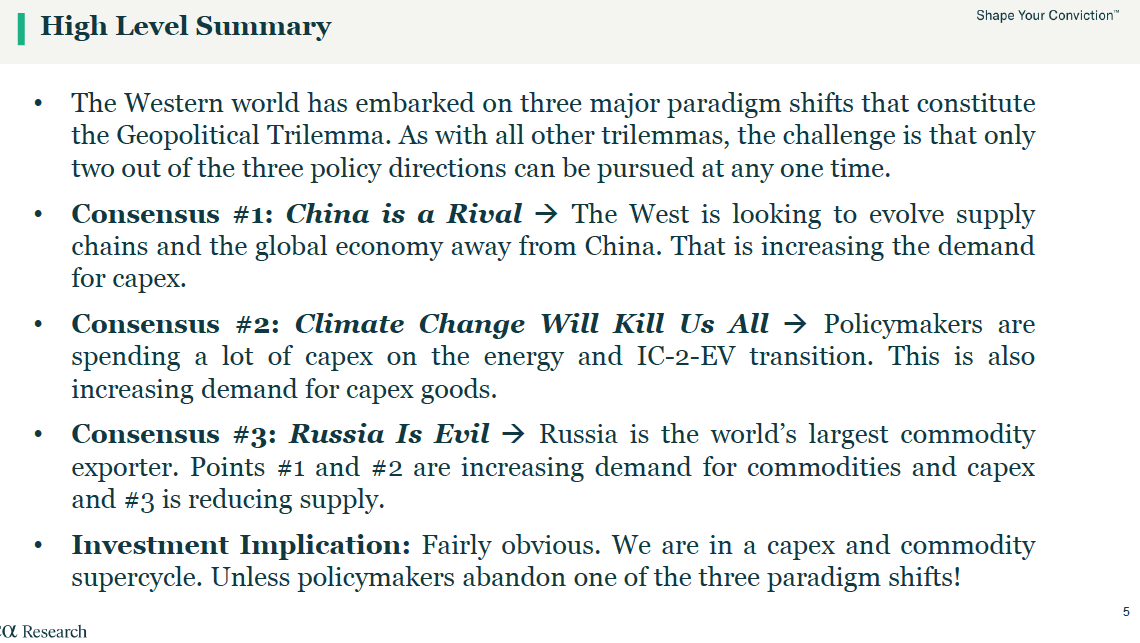

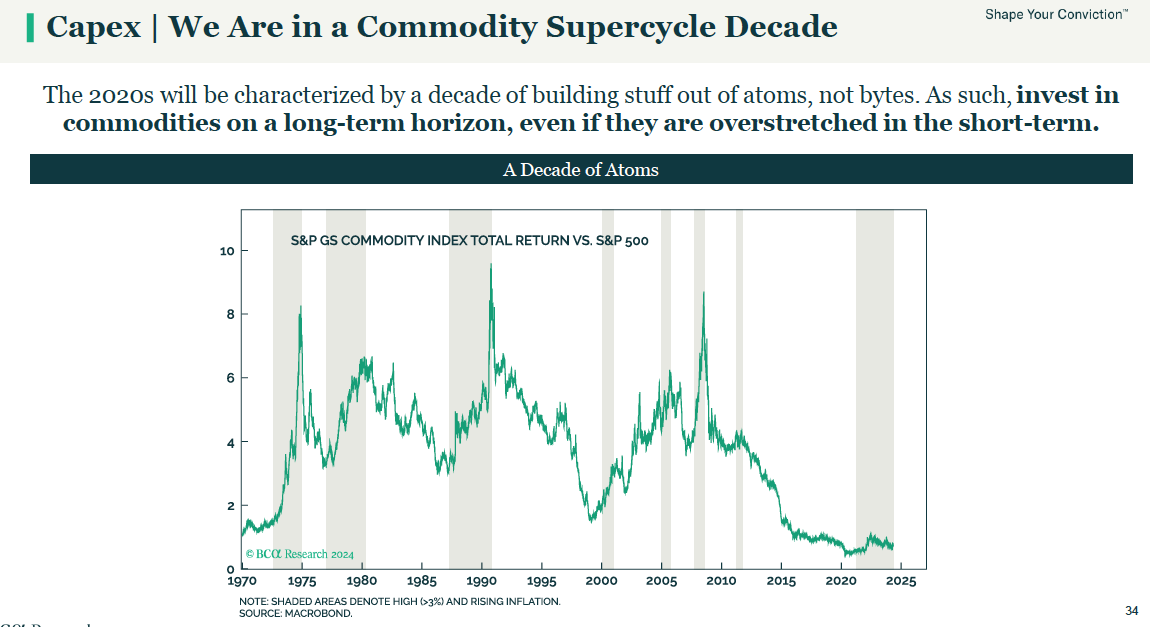

US Elections: Senate and House will be Republican, and the White House probability is 60/40 in Trump’s favour. A Harris win will mean legislatively nothing will get done because Republicans will block it. A Trump win will mean a lot more fiscal spending, tariffs. Most things lead to higher rates, and dollar lower. Expects rest of the world equities and Commodities to outperform.

The Middle East: Iran and Saudi Arabia have a detente. Unlikely things escalate in the region even if Israel further attacks Iran. But US will need to work on Iran uranium stockpile in 2025.

China: Wants a deal with the US and rest of the world, and is making changes domestically. They might feel slow, but you will look back in a year and see how much they have done. Look for more Chinese manufacturing plants built in the US.

Europe: Levered to capex cycle that we have embarked on and there is a tidal wave of LNG heading to Europe next year which will bring energy prices way down.

Boiling 100 page slide deck, to top 5 slides:

3. If only there were signs of the top…..

The Economist had a multi-part special report on the US Economy.

4. Scott Bessent of Key Square Group spoke to Michael Green. Scott will very likely be someone at the top of the Trump Economic Team.

It’s a masterclass combining high-level theoretical frameworks with detailed ground-level observation, always emphasising the need to understand both structural forces and practical limitations in implementing change.

The 5 BIG IDEAS:

The Three-Body Economic Problem: Scott frames current challenges as a complex "three body problem" between: Asset inflation (stocks, housing), Large fiscal deficits (6.77% of GDP), Treasury's shift to short-term funding. Like physics' three-body problem, these interacting forces create unpredictable outcomes.

Historical Power Transitions & Currency: Reserve currencies change with military power. US is 6th global reserve currency (after Portugal, Spain, Holland, France, UK). Each was dominant military power of their time. Suggests need for: new "Federation" or "Commons" approach with allies: "Friend-shoring" with clear criteria for allies, potential for military bonds backed by Fed repo facility, more formal economic/security integration.

Equilibrium Dynamics & Policy Change: Scott repeatedly emphasises Soros's insight: "You're never at equilibrium - you're either moving toward it or away". Applies this to multiple contexts: Japan's rate policy: Behind curve but must return to equilibrium. China's rebalancing: Need gradual pressure toward new equilibrium. Yuan has "three different equilibriums" (PPP, capital controls, access risk). Policy implication: Focus on direction of change rather than end state.

Bifurcated Economic Reality: Asset ownership as key dividing line. Different inflation experiences by quintile. Generational aspects (young people's asset acquisition). Geographic components (South Carolina subprime example). Creates different policy experiences: Top 20% drives 40-50% of consumption. Bottom quintiles see 2x median inflation expectations. Explains divergent economic narratives

Strategic Patience & Systems Thinking: Key metaphor: "Two 350lb two-pack-a-day smokers" can't be put on treadmill immediately. Applies to: US-China rebalancing (10-year project). Tariff policy (gradual escalation). Japan's corporate governance shift (30+ year evolution). He emphasises:

Need for probabilistic thinking ("never say never, never say always"), focus on getting "to the other side of 50% confidence", importance of persistence in talking to "real world", understanding how "micro drives macro".

5. A few of the market greats gave interviews.

Paul Tudor Jones was on CNBC talking markets.

TL;DR: Sees massive inflation ahead of us under trump and short long end of the curve. Sees US taxes higher, there is no choice with deficits rising faster than the oceans. All roads lead to inflation. Long bitcoin, commodities, gold. Playbook to get out of this is to inflate our way out of debts. Fed has to continue easing

Stan Druckenmiller on Fed Policy, Election, Bonds, Nvidia

B. Setting the Table

We are all in the hospitality business. No matter what you do and who you work with people are at the centre of your business. This could be your customers, your employees, your investors, your suppliers or just your family.

Hospitality is about you make these people feel.

There is probably no other business that touches people as regularly as the food business and Danny Meyer has really figured out how to make people feel good.

Setting the Table is the life story of Danny Meyer, the man behind Union Square Cafe, Gramercy Tavern, Eleven Madison Park, Blue Smoke, Tabla, Shake Shack and the story of his philosophy of enlightened hospitality.

The key quotes:

Hospitality is the foundation of my business philosophy. Virtually nothing else is as important as how one is made to feel in any business transaction. Hospitality exists when you believe the other person is on your side. The converse is just as true. Hospitality is present when something happens for you. It is absent when something happens to you. Those two simple prepositions - for and to - express it all.

The quality of the experience is directly proportional to the quality of the detail.

Anticipate customer needs before they ask.

Here he is in a conversation with Tony Robbins:

C. Only Paranoid Survive

A book I think about regularly is the late Andy Grove's “Only the Paranoid Survive”.

It is particularly relevant today with the pace of change and the need for businesses to adapt and change.

The book was pivotal in business strategy that delved into the concept of strategic inflection points—those crucial moments when an organisation must pivot in response to significant changes in its competitive environment.

The book drew from his transformative leadership at Intel, particularly during the company’s bold transition from memory chips to microprocessors.

He argued that a proactive mindset, marked by a healthy dose of paranoia, is essential for leaders to identify and respond to potential threats.

The 2 BIG IDEAS:

Strategic Paranoia: Watch and understand the strategic inflection points in your industry. What is the 10x force trying to destroy you. Ask questions, look at what others are doing and see how others are adapting. Don’t be closed and insular. When in doubt, ask you yourself, if you were fired and they brought in a replacement, how would that think and evaluate the business.

Accepting Reality: Once you see and accept the change coming, don’t dither or hesitate. Act immediately. Focus only on dealing with change. Fix the issue. There will be anger, but its better to handle it early. With all interactions, people, work, ask yourself: “Is this helping me deal with change?”, if so then do it, if not then do not.

D. The Science and Technology Section:

1. Nicolai Tangen at Norges Bank spoke to Vinod Khosla about: Future trends and the Power of the Improbable.

The 4 BIG IDEAS:

THE IMPROBABLE AS INNOVATION ENGINE: The most transformative changes come from seemingly improbable scenarios that experts initially dismiss. While any single improbable event is unlikely, the emergence of some improbable breakthrough is inevitable. Success requires backing entrepreneurs who think from first principles rather than experience. Traditional expertise often becomes a liability in transformative change, as industry veterans are constrained by past patterns and conventional wisdom.

For investors, this means building portfolios of "improbable but transformative" bets rather than seeking predictable returns. The goal isn't picking the single right moonshot, but creating systematic exposure to multiple high-impact possibilities.

THE ZERO-COST REVOLUTION: We're entering an era where economic inputs approach zero cost. AI will make expertise free and infinitely replicable. Robotics will transform physical labor. Energy costs will plummet through fusion and solar advances. Computing will become as ubiquitous as electricity.

This convergence creates positive deflation - when core inputs approach zero cost, it enables unprecedented abundance. The challenge becomes distribution and adaptation rather than production capacity. Traditional business models built on scarcity must evolve to harness nearly-free inputs in novel ways.

THE GREAT RECONFIGURATION: Society isn't just changing - it's fundamentally restructuring. Cities will transform through autonomous point-to-point transit. Healthcare will shift to personalized N=1 medicine. Entertainment will become interactive and adaptive. Education will focus on passion rather than employment.

This reconfiguration demands new business models. Success will come from enabling new systems rather than optimizing old ones. The biggest opportunities lie in facilitating this transition, not just applying new technology to existing frameworks.

THE POLICY/PROGRESS TENSION: Policy and social acceptance, not technology, will determine transformation speed. Different regions will adopt at vastly different rates, creating both risks and opportunities.

Early adopters will gain competitive advantages while those resisting change fall behind. Understanding the policy environment becomes as crucial as understanding technology. Timing and market entry strategies must account for regulatory frameworks and social acceptance.

2. Anthropic just launched a new feature that can control desktop apps via a new "Computer Use" API. It emulates human interactions like keystrokes and mouse gestures, allowing it to perform tasks on a PC.

A great start to everyone being able to build their own AI Agents.

3. Jennifer Doudna on the Brave New World Being Ushered In by Gene Editing.

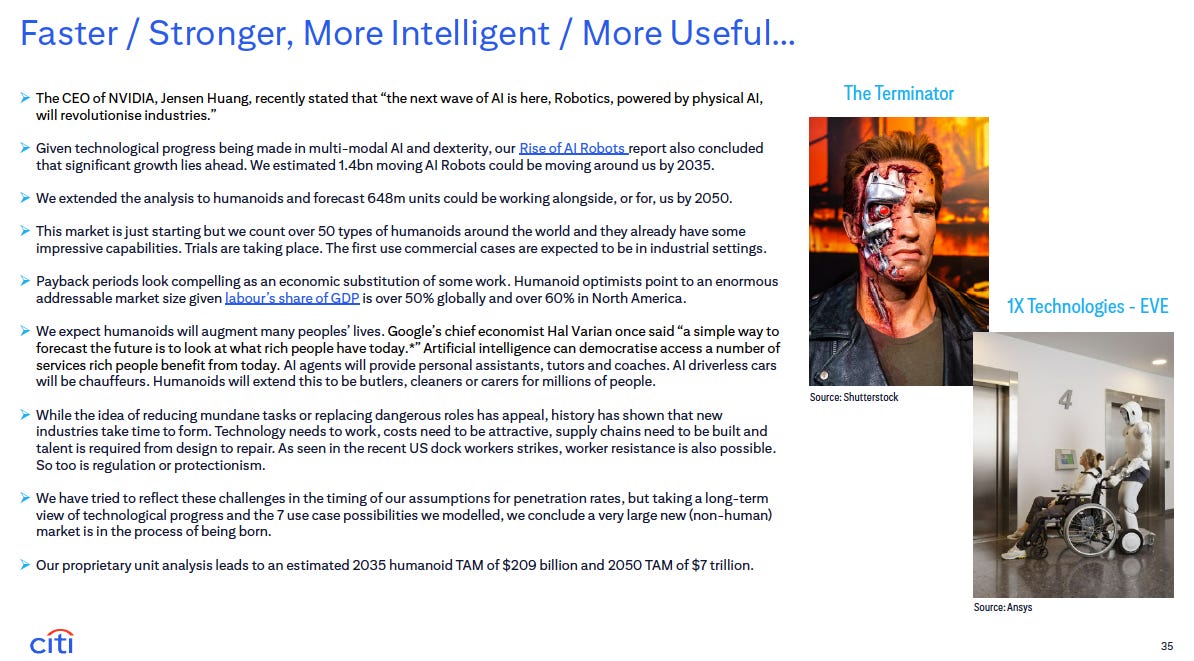

4. Citi had a great report on Humanoids by Rob Garlick and team.

This ties in well with NVIDIA’s video, released yesterday on Physical AI:

Which inevitably made me think of this amazing show.

P.S. Could you do me a favor ? This email takes many hours to put together, including hours of sourcing, curating and writing. If it is helpful to you, then do me a favor and hit the “heart” button so I know it’s useful to you.

Finally watched Field of Dreams on a flight and it made me cry.

It’s a movie about connecting and paying deeper attention to your life.

They don’t make them like they used to.

Wishing you a good and beautiful life.