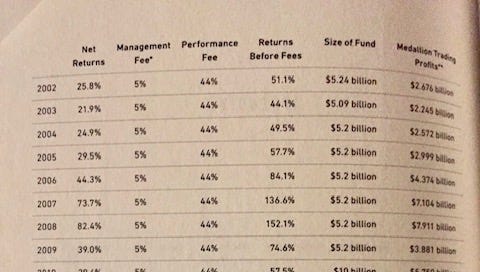

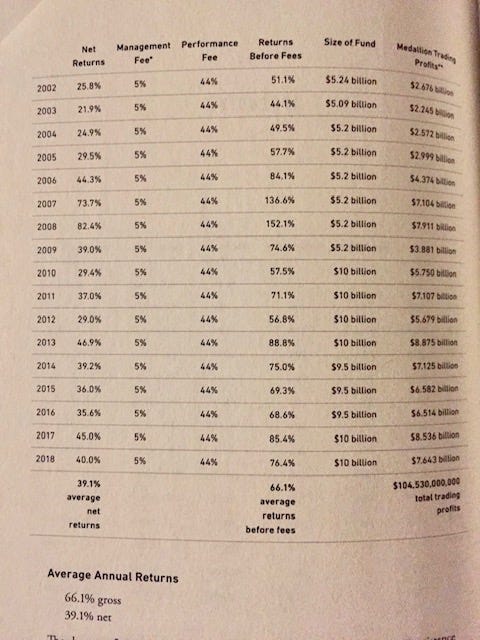

1. How to make 66% annualized over 17 years…..

A number of you are reading the Greg Zuckerman book - The Man Who Solved The Markets about Jim Simons Renaissance Technologies.

Firstly for the uninitiated, here’s why people care:

And even after Renaissance’s fees and carry, investors were left with 39% net return from 2002 to 2018. To put that into context,…