A. On Markets:

Bloomberg put together a great overview of all the 2020 market predictions from the major shops. It’s searchable by asset and theme and a great way to see consensus around what the street is thinking.

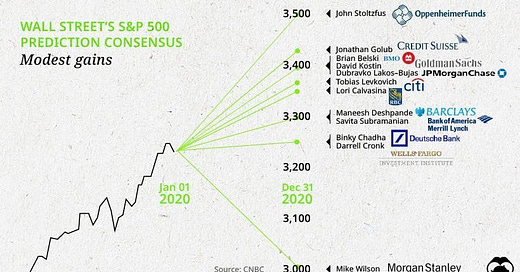

The consensus will almost certainly be wrong. This year… the herd is calling for no recession, a muddle-through low growth economy, and ver…