How are you ? Is everything ok ?

I could stop there, since that’s the only thing that really matters.

A. What Now ?

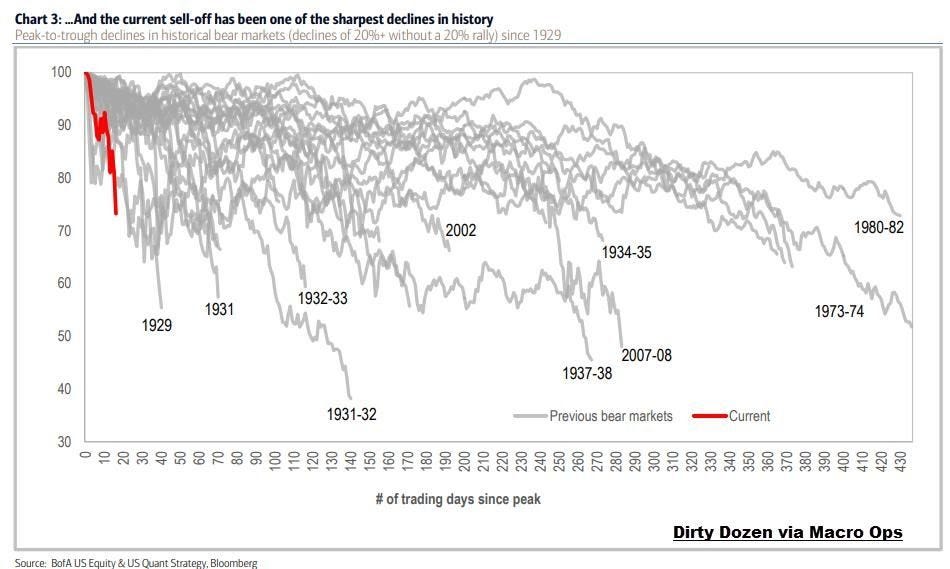

To answer what happens now, we first have to understand where we are and how we got here. Let’s look at the type of financial crisis we might be going through.

There are typically two types of financial crises.

Solvency Crisis

Liquidity Crisis

…